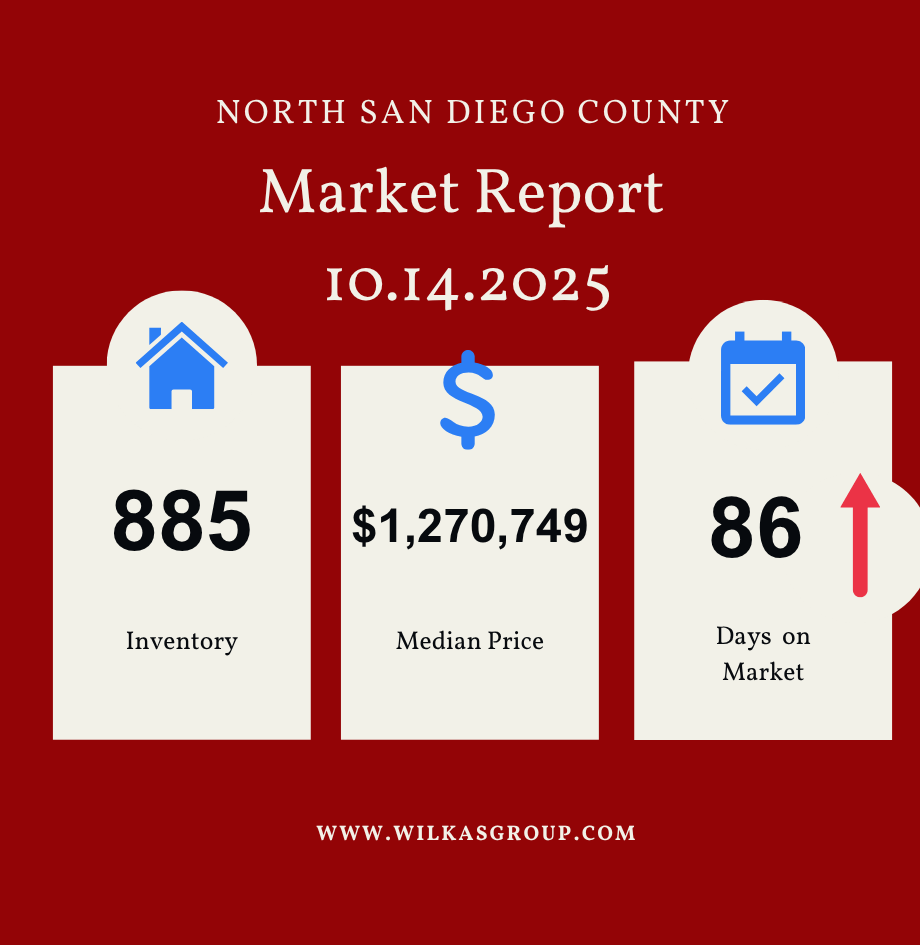

North County's Market Report for October 14, 2025

Here's what the market looked like last week, and likely will remain so this week, as well.

Just for fun, I asked ChatGPT to look at all of the data I've written about since beginning this newsletter in May. Here's what they say:

Between May and September 2025, North County's housing market transitioned from mild seller dominance to a balanced phase. Inventory normalized, Days on Market lengthened, and pricing plateaued. Trend modeling now projects moderate softening through February 2026 as higher supply meets more cautious demand.

Projected Price & Inventory Trends (to Feb 2026)

Price Forecast (% change vs Sep 2025 avg)

- Carlsbad: −5% → resilient luxury segment.

- San Marcos: −3% → stable upper mid-market.

- Vista: −11% → steepest expected correction.

- Oceanside: −8% → rate-sensitive entry zone.

- Escondido: −9% → oversupply softens values.

- Fallbrook: −7% → mild seasonal retreat.

Inventory Forecast (% change vs Sep 2025 avg)

- Carlsbad: +27%

- Oceanside: +10%

- Vista: +5%

- San Marcos: −7%

- Escondido: +4%

- Fallbrook: +3%

So, what does this all mean? Carlsbad and San Marcos are hot and in a balanced market. The other cities are good for buyers and sellers leaning more towards a buyers market.

Overall Market Trends

|

Metric |

May → Sep 2025 Change |

Direction |

Key Insight |

|

Median List Price |

$1.23M → $1.30M |

🔼+5.7% |

Prices have generally stabilized after a mid-summer dip. |

|

Median New Price |

$1.26M → $1.20M |

🔻 -4.6% |

Sellers are moderating expectations, possibly responding to slower buyer demand. |

|

Average Days on Market (DOM) |

61 → 84 |

🔼 +38% |

Homes are staying on the market longer — indicating cooling demand or seasonal slowdown. |

|

Inventory |

887 → 902 |

⬆️+1.7% |

Supply is steady but elevated compared to early summer; balanced market conditions emerging. |

|

Weekly Sales Volume |

110 → 119 |

⬆️+8.2% |

Despite longer DOM, sales volume remains healthy — suggesting serious buyers are still active. |

Categories

Recent Posts

Real Estate Advisors | License ID: 01343201 & 01355442

+1(760) 407-2100 | wilkasgroup@lilyfieldre.com